For business owners in Louisiana, navigating the ever-changing landscape of insurance options can be a difficult task. In this blog post, we will provide an overview of essential business insurance policies your Louisiana should consider, helping you make informed decisions for your organization.

Required Coverage: Workers' Compensation

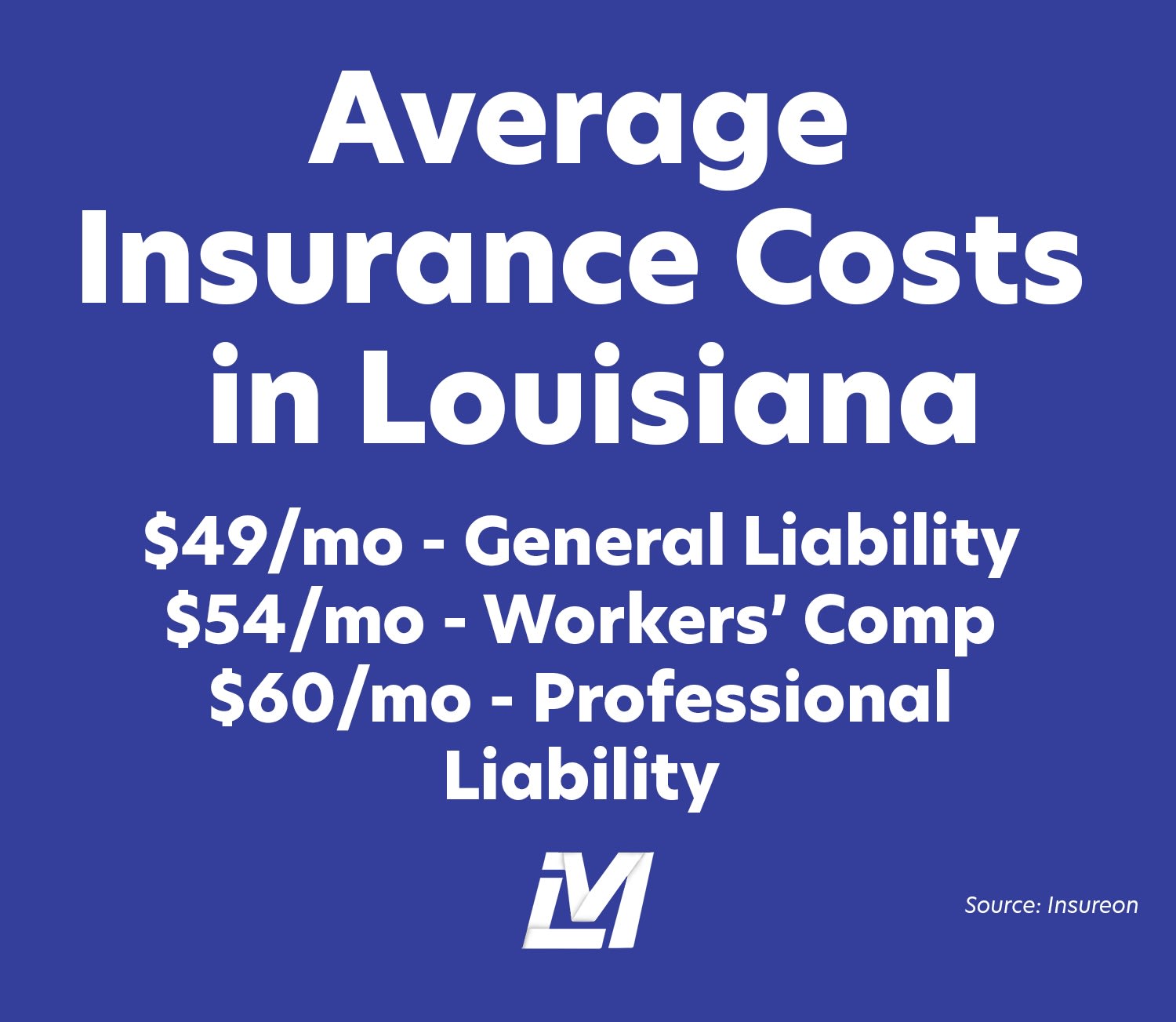

Louisiana law mandates that all businesses with one or more employees (including part-time, temporary, and seasonal workers) carry workers' compensation insurance. This policy safeguards your company from financial liability if an employee sustains a work-related injury or illness. It covers medical expenses, lost wages, and rehabilitation costs associated with the injury.

Essential Coverage: General Liability

A general liability insurance policy is one of the most basic, but essential policies you should consider. This type of insurance policy shields your business from financial repercussions in the event of a lawsuit alleging third-party bodily injury or property damage arising from your business operations. This could include customer slip-and-fall incidents, product malfunctions, or property damage caused by your employees.

Additional Considerations: Business Owner's Policy (BOP)

For many small and medium-sized businesses, a Business Owner's Policy (BOP) offers a cost-effective solution by bundling multiple policies together. BOPs typically combine general liability coverage with business property insurance, protecting your building, equipment, and inventory from various perils such as fire, theft, and vandalism. Some BOPs may offer additional coverages like business interruption insurance, which helps mitigate financial losses if your operations are halted due to a covered event.

Industry-Specific Needs

Beyond the essential coverages, specific industries may require additional insurance policies. For instance, professional service providers like consultants or architects may benefit from professional liability insurance (E&O) to protect against negligence claims. Businesses that handle sensitive customer data might consider cyber liability insurance to address data breaches and cyberattacks.

Having the right insurance plan is an investment in your company's long-term success. By consulting with a qualified insurance agent, you can tailor a comprehensive insurance portfolio that meets your specific needs. An experienced agent can guide you through the various coverage options, explain policy exclusions, and help you secure a competitive rate. If you need insurance for your Louisiana-based business, give us a call or contact us through our website!